Magna International: An Undervalued Stock with Consistent Above-Industry ROIC, Under Levered Balance Sheet, and Strong Free Cash Flow Generation

MAGNA INTERNATIONAL

Auto Parts & Equipment

Price: $41.67

Target: $57.7

In the last two weeks, I studied the evolving auto industry, particularly how OEMs and suppliers are balancing investments in the EV transition while continuing to stay profitable with ICE sales. You can read these here.

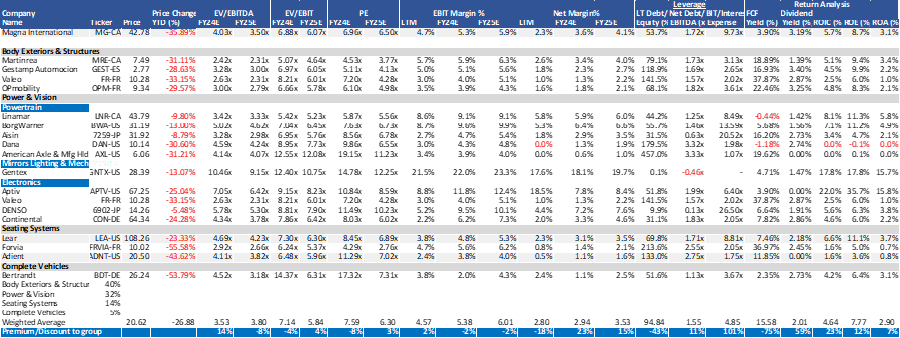

As next steps, I examined the key players among OEMs and suppliers, focusing on their stock performance amidst the current industry landscape. The analysis reveals that the sector has faced significant headwinds, leading to an overall underperformance, evident in YTD %chg. in following table. These challenges include persistent supply chain disruptions, escalating costs due to UAW strikes, inflationary pressures, and a decline in volumes.

Amidst these industry-wide struggles, I take a closer look at Magna International, a prominent supplier, and argue that its stock is currently undervalued. Through a detailed examination of the company's financials, market position, and strategic initiatives, I present a case for why Magna International is trading at a discount, offering potential value to discerning investors.

COMPANY PROFILE

Magna International, Inc. is a mobility technology company, which engages in the design, engineering, and manufacturing of automotive supplies. It operates through the following segments: Body Exteriors & Structures, Power & Vision, Seating Systems, and Complete Vehicles.

1. The Body Exteriors & Structures segment includes body and chassis systems, exterior systems, and roof systems operations.

2. The Power & Vision segment comprises of global powertrain systems, electronics systems, mirrors, lighting, and mechatronics operations.

3. The Seating Systems segment deals with global seating systems operations. The Complete Vehicles segment focuses on vehicle engineering and manufacturing operations.

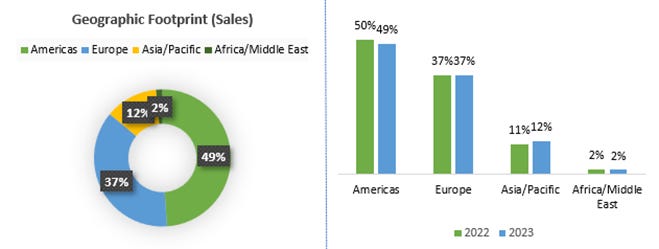

GEOGRAPHIC FOOTPRINT

Magna boasts a well-diversified revenue profile, with exposure across 76 countries, which significantly mitigates its overall risk. The company’s largest market is the United States, followed by Austria and Mexico. In response to the rising demand for EVs in China, Magna has strategically expanded its operations in Mainland China to capitalize on these emerging opportunities. Meanwhile, it has consciously reduced its exposure to the Canadian market over the past three years, aligning its focus with global growth trends.

CLIENT PROFILE

Magna's extensive size and comprehensive product offerings have enabled it to establish a vast network of clients, providing complete vehicle solutions. The company's revenue dependency on major industry players, many of whom hold investment-grade ratings, suggests a stable revenue stream with reduced volatility. This strong client base also positions Magna with the capacity to pass through rising costs to OEMs, further enhancing its financial resilience in a challenging market environment.

KEY FINANCIALS

Recovering Profitability

Magna's profitability has shown a declining trend in recent years, with EBIT margins dropping from 5.2% in 2021 to 2.3% in 2022, before a modest recovery to 3.9% in 2023. This suggests ongoing challenges in maintaining profitability despite recent improvements in sales growth.

Strong Interest Coverage and Leverage

Magna has seen a gradual rise in leverage, from 2.3x in 2019 to 2.6x in 2023, primarily due to its investments in electrification. Despite this, the company maintains a solid interest coverage ratio, which, although reduced from 25.9x in 2019 to 10.6x in 2023, still reflects its strong ability to service debt. Additionally, the net debt/EBITDA ratio has increased from 0.5x to 1.1x over the same period, remaining at manageable levels while supporting strategic growth initiatives.

ROIC Above Industry Average and WACC

Magna has consistently generated returns higher than the industry peers and its Weighted Average Cost of Capital (WACC), a key indicator that the company is creating value—a crucial metric that value investors often seek. This positive ROIC spread over WACC highlights Magna's efficiency in deploying capital and generating shareholder value. However, more recently, the company has faced challenges within the industry, which is reflected in the declining NOPAT margins.

Analyzing the drivers of ROIC, it's evident that while asset turnover has remained consistently strong over the past decade, NOPAT margins have declined. In 2023, Magna's sales growth was propelled by new program launches, increased global vehicle production, acquisitions, and customer price increases. However, this growth was partially mitigated by challenges such as UAW strikes, currency fluctuations, the idling of Russian facilities, and net price concessions. On the EBIT side, the company saw gains from higher sales, improved productivity, cost efficiencies, favorable commercial terms, and customer recoveries. Nonetheless, these gains were offset by rising costs, including those related to launches and engineering, unfavorable commercial items, and the ongoing impact of UAW strikes and currency volatility.

Thesis 1 – Rising Production Volume, Declining Raw Material Cost And Improving Supply Chains To Improve Margins

Between 2020 and 2022, Magna faced significant challenges, including COVID-19-induced supply chain disruptions, raw material shortages, inflationary pressures, and OEM production struggles due to semiconductor shortages and UAW strikes. Now, with supply chain issues easing, raw material costs declining, and global efforts addressing the semiconductor shortage (Exhibit 1, Appendix), both supply-side pressures and OEM demand constraints are improving, signaling a more favorable outlook for Magna.

Thesis 2 – Partnership And Equity Investments In Electrification To Drive Future Growth

Magna International has strategically positioned itself to capitalize on the rising demand for electric vehicles (EVs) while maintaining a balanced approach to sustaining revenue from internal combustion engine (ICE) vehicles. Through key investments such as the LG Magna e-Powertrain joint venture, which focuses on producing essential EV components like electric motors, inverters, and chargers, Magna is reinforcing its foothold in the electrification sector. Additionally, Magna's partnership with Fisker to manufacture the all-electric Ocean SUV highlights its commitment to supporting next-generation EVs. The company's investment in Innoviz Technologies, providing advanced LiDAR systems for both EVs and ICE vehicles, further solidifies its role in the evolving automotive landscape. Meanwhile, Magna continues to generate substantial revenues from ICE vehicles, ensuring that it can support the industry's transition while leveraging its expertise in both domains. This dual strategy allows Magna to drive future growth by meeting the increasing EV demand without sacrificing its established position in the traditional automotive market.

Rising BEV share globally

Key Investments/Partnerships in 2019-2023

Strong Cashflow Profile for Future Investments

Thesis 3 - Below And Average Valuation Than Peers And History In Context Of Above Avg Sales And Earnings Growth In 2016-2020

Magna demonstrates a competitive advantage with lower Price-to-Earnings (P/E) and EV/EBIT ratios compared to its peers, suggesting that it may be undervalued relative to the group. Despite the lower valuation multiples, Magna outperforms its peers with better EBIT and net margins, indicating superior profitability. Additionally, Magna showcases a stronger return profile, including higher Return on Equity (ROE) and Return on Assets (ROA), coupled with a more favorable leverage position, reflecting lower long-term debt relative to equity and interest expense coverage.

VALUATION

MGA currently trades at 3.5x EV/EBITDA and 6.4x P/E on my 2025E, which compares to its historical trading ranges of 4-6x and 6-11x, respectively. On a relative valuation basis, MGA’s peer group consists mainly of direct competitors across its four reporting segments as well as similar-focused suppliers, trading at collective weighted-avg. multiples on 2025E of 3.8x EV/EBITDA and 6.3x P/E. My $57.7 price target reflect EV/EBITDA and P/E multiples on our 2025E of 6x and 13x, respectively.